Operating income is a measure of a company’s profitability that excludes interest and taxes. It’s also sometimes referred to as “operating profit” or “operating earnings.” This includes not just the operating income but also non-operating expenses. These are extraordinary or non-recurring expenses — things you wouldn’t regularly be spending money to run your business such as a large equipment purchase that only happens once every 4-5 years.

To put it another way, Diego made a credit sale in YEAR 1 and received the money due to him in YEAR 2. Catching the imbalance early gives founders and their financial team the ability to redirect funds and alter budgets before the problem becomes costly. In traditional bookkeeping, books are delivered after the month net profit vs operating profit is over, eliminating the ability to pivot when the issue starts. Take a read of the given article to underdtand the difference between gross, operating and net profit. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

The Best Business Financing Options And Alter…

Operating profit doesn’t include any profits earned from investments and interests. It is also known as Operating Income, PBIT and EBIT (Earnings before Interest and Taxes). Interest expense relates to the cost of borrowing money (Wikimedia Foundation, 2020) [11]. It is the price that a lender charges a borrower for the use of the lender’s money (Wikimedia Foundation, 2020) [11].

Similarly, you may not have paid the supplier for some of the expenses that are accounted for. Both these transactions will affect your net profit, but will not have an impact on your cash balance. Once you carry out this calculation, you can use the gross profit rate to estimate the gross profit you would make with an increase in sales.

- To determine how your business stacks up against other companies in your industry, you should look at the average profit margin by industry.

- Our software allows founders to make changes immediately due to real-time transaction tracking.

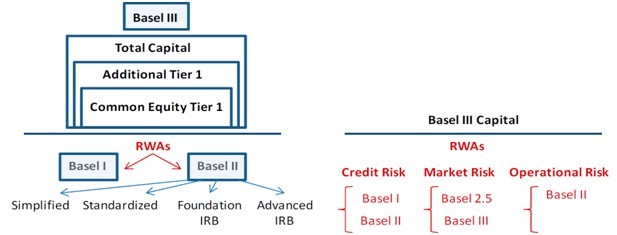

- EBIT can include non-operating revenue, which is not included in operating profit.

- Gross profit, operating profit, and net income are reflected on a company’s income statement, and each metric represents profit at different parts of the production cycle and earnings process.

- All three financial metrics, gross profit, operating profit, and net income, are located on a company’s income statement, and the order in which they appear shows their significance and relationship.

However, operating income is generally considered to be a more important measure because it provides insights into a company’s profitability from its core business operations. This is important because it allows investors to see how much profit a company is generating from its core business, without the impact of things like interest expense, taxes, and one-time gains or losses. Net profit is often considered the most important type of profit since it reflects the true financial health of an organization. It is calculated by deducting all expenses including taxes and interest payments from total revenue earned during a given period. Profit earned from a firm’s core business operations is called Operating Profit. So a shoe company’s operating profit will be the profit earned only from selling shoes.

Why is Net Income Important?

However, the level of knowledge that business owners have about their firms’ profits isn’t as precise. Ideally, a good operating margin is one that is positive and steadily increasing over time. Since the capital structures, levels of competition and scale efficiencies are different from industry to industry, the operating margins can vary widely. By keeping an eye on both metrics and understanding their relationship with each other, you’ll be better equipped to manage your procurement processes effectively and grow your business over time. Gross profit is only part of your company’s profitability, while net profit looks at the complete picture. You may think that net profit is more important but gross and net profit measurements are helpful.

Lastly, net profit denotes the amount of earnings left with the firm, after deducting all expenses, interest and taxes. It is a key indicator of company’s ability to convert sales into profit. Both operating income and net income are important measures of a company’s profitability.

Upgrade your financial models

While income indicates a positive cash flow into a business, net income is a more complex calculation. Profit commonly refers to money left over after expenses are paid, but gross profit and operating profit depend on when specific income and expenses are counted. Overhead costs, such as sales, general and administrative expenses (SG&A) are also deducted from revenue and reflected in operating profit. Overhead costs are not directly tied to production, such as the expenses for running the corporate office.

This is the percentage of sales that is in excess of the cost of goods sold. Operating margin of a business is the profit that the business makes after paying variable costs of production but before paying tax or interest. If a company can steadily increase its net income over time, its stock share price will likely increase as investors buy up outstanding shares of stock. As a result, a higher EPS typically leads to a high stock price–all else being equal. However, it’s important to note that increasing revenue alone won’t necessarily lead to profit growth if expenses also increase. For example, let’s say that your company has a lot of debt leading to high-interest expenses.

Key Differences Between Gross Profit, Operating Profit and Net Profit.

COGS represents direct labor, direct materials or raw materials, and a portion of manufacturing overhead tied to the production facility. It’s important to note that a company can generate a positive number for operating profit but have a loss or report negative net income for the quarter or fiscal year. If the interest expense was $110 million for the period, the company would record a $10 million loss in net income despite producing $100 million in operating profit. The operating profit margin shows how effective a company is at managing its costs, which providing an evaluation of the strength of a company’s management.

- To calculate net revenue, you add up sales income – not just what customers paid but also credit sales – and adjust it for discounts, allowances and returns.

- Operating profit doesn’t include any profits earned from investments and interests.

- It is a key indicator of company’s ability to convert sales into profit.

- In another way in literature in calculating the net profit is stated as below as defined by Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010) (Wikimedia Foundation, 2020) [15].

- Net income is important because it shows a company’s profit for the period when taking into account all aspects of the business (Kagan, Investopedia, 2020) [12].

It represents the income that the business generated during the reporting period covered by the statement. When calculating operating profit, subtract operating expenses from gross profit. Your operating expenses should include any overhead costs like administrative salaries. Operating income is important because it provides insights into a company’s profitability from its core business operations. Non-operating expenses include things like interest expense, taxes, and one-time gains or losses.

Operating Income

In other words, operating profit is the profit a company earns from its business. The metric includes expenses for the raw materials used in production to create products for sale, called cost of goods sold or COGS. Operating profit also includes all of the day-to-day costs of running a business, such as rent, utilities, payroll, and depreciation.

If higher sales don’t counterbalance the added cost of COGS, money problems can start to snowball. In this blog post, we’ll take a closer look at the difference between gross profit and operating income and why those numbers are beneficial for founders to know. Remember that when calculating operating profit, the interest cost incurred on loans is not to be considered. Net income refers to the profits of the business after accounting for all income and expenses.

Operating Income vs. Net Income: Which is More Important?

Essentially, operating income measures a company’s profitability from its core business operations. Operating Profit is the profit that is earned from the regular activities of the business or the enterprise. This can also be termed Earnings Before Interest and Taxes (EBIT), which should not be any Non-Operating Income. Net Profit is the positive value (surplus) that remains with the company or the firm after deducting or accounting for all expenses, interest, and taxes.

CJ Cheiljedang Q2 net profit nearly halves on global economic … – The Korea Herald

CJ Cheiljedang Q2 net profit nearly halves on global economic ….

Posted: Mon, 07 Aug 2023 11:14:57 GMT [source]

The difference between EBIT and operating income is that EBIT includes non-operating income, non-operating expenses, and other income. Investors typically want to know how much profit is being generated on a per-share basis because it shows how well a company has invested those funds that were raised from issuing stock. A higher earnings per share means a company is growing profits based on the number of stock shares that they’ve issued. EPS is helpful because it can be used to compare the profit of companies in different industries since it’s a universal metric that all publicly-traded companies use for measuring profitability. EPS also shows how well a company’s management team is at investing in the long-term financial viability of the company.